ADP Survey points to a strong Non Farm Payroll today and further build-up of inflationary pressures. Digital assets consolidate after latest tweet from Musk

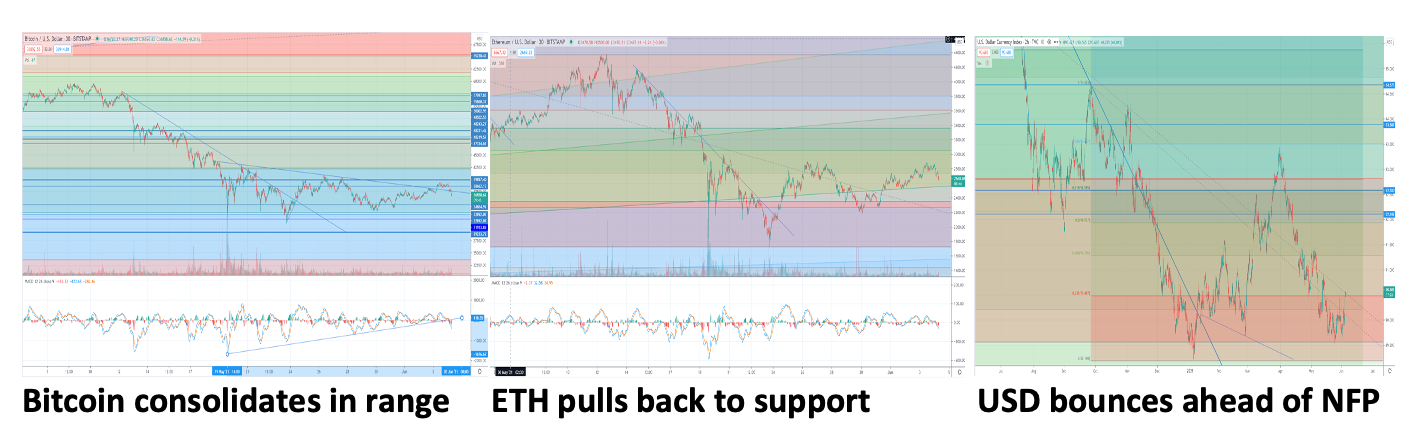

The Digital assets recovery rally stalled temporarily overnight with another Musk tweet compounding the impact from the rising Dollar after stong employment data and a warning from the FCA that a high number of crypto businesses in the UK are not meeting AML standards. Bitcoin failed to regain $40k with $42,400 the next significant upside target. However, expectations remain supportive with a growing awareness that institutions and HNWIs are accruing Bitcoin and Ethereum on dips.

US equity indices edged lower yesterday in the wake of strong data and ahead of today’s important non-farm payrolls. The S&P pulled back 0.4%, with tech stocks underperforming. With the Nasdaq 100 -1.1%. Whilst Bitcoin has naturally had a positive short-term correlation with tech given the retail ownership, the rising inflationary pressures will continue to build driving demand for Digital Gold. Goldman Sachs and other strategists have highlighted that China will not be able to manage down commodity prices for its manufacturing exports as there is too much global demand for commodities as inflation continues to grow. The robust US ADP employment report and further declines in unemployment claims point to a strong Non-Farm Payrolls report today. The ADP survey showed a monthly increase in non-farm employment by a massive 978K in May, compared to market consensus of 650K (a beat by 50%). Most of the new 850k jobs were added in the service sector, particularly leisure and hospitality. Furthermore, the 385k new claims number was a fresh pandemic era, marginally below consensus. Combined, the data paint a favourable picture for the state of the labour market, in stark contrast to the most recent payrolls report a month ago. The indications are therefore for a strong non-farm payrolls report today (consensus is for a 674K increase, with the range of estimates unusually wide). The PMI services data for April were also well above expectations.

US Treasury yields rose in the wake of the data releases, with 10-year UST yields up nearly 4bp at 1.625%. The dollar index jumped 0.7% to a 3-week high. The combination of higher yields and stronger dollar has sent gold price 2% lower to $1,870. The strengthening dollar precluded oil prices from holding to early gains, alongside a report showing a 1.5mn/bbl increase in gasoline stocks over the past week. Oil futures were down 0.5% this morning.

Today is the key day of St Petersburgh Economic Forum, Russia’s key annual event for foreign investors. This year’s Forum has special significance with an address by President Putin later today. Until now, the main newsflow has come in the form of comments from senior finance ministry and central bank officials. Finance Minister Siluanov announced yesterday that the share of USD-denominated assets in Russia’s sovereign wealth fund (the National Welfare Fund) is being cut from 35% to zero over a short period of time. This is the most significant change in the currency structure of the fund since its inception in 2008. As of 1 May, the amount of USD assets at the Fund was nearly $40bn. The bulk of the conversion will be from USD into CNY (the share of China’s currency is being bumped up further, from 15% to 30%, the euro from 35% to 40% and gold from zero to 20%. The share of GBP is being cut from 10% to 5%. The NWF $186bn assets are part of much larger pool of total FX and gold reserves managed by the central bank. The shift away from US assets is driven by geopolitics / sanctions risk. Historically, large holders of US securities have reduced their exposure during elevated bilateral tensions (eg Saudi Arabia after 9/11). CBR officials guided towards a 25bps rate increase.